Caribbean Business Insights

Exploring the vibrant business landscape of the Caribbean.

Riding the Wave of Marketplace Liquidity Models

Discover innovative marketplace liquidity models that can elevate your business strategy and maximize profits. Ride the wave of success today!

Understanding Marketplace Liquidity Models: An Essential Guide

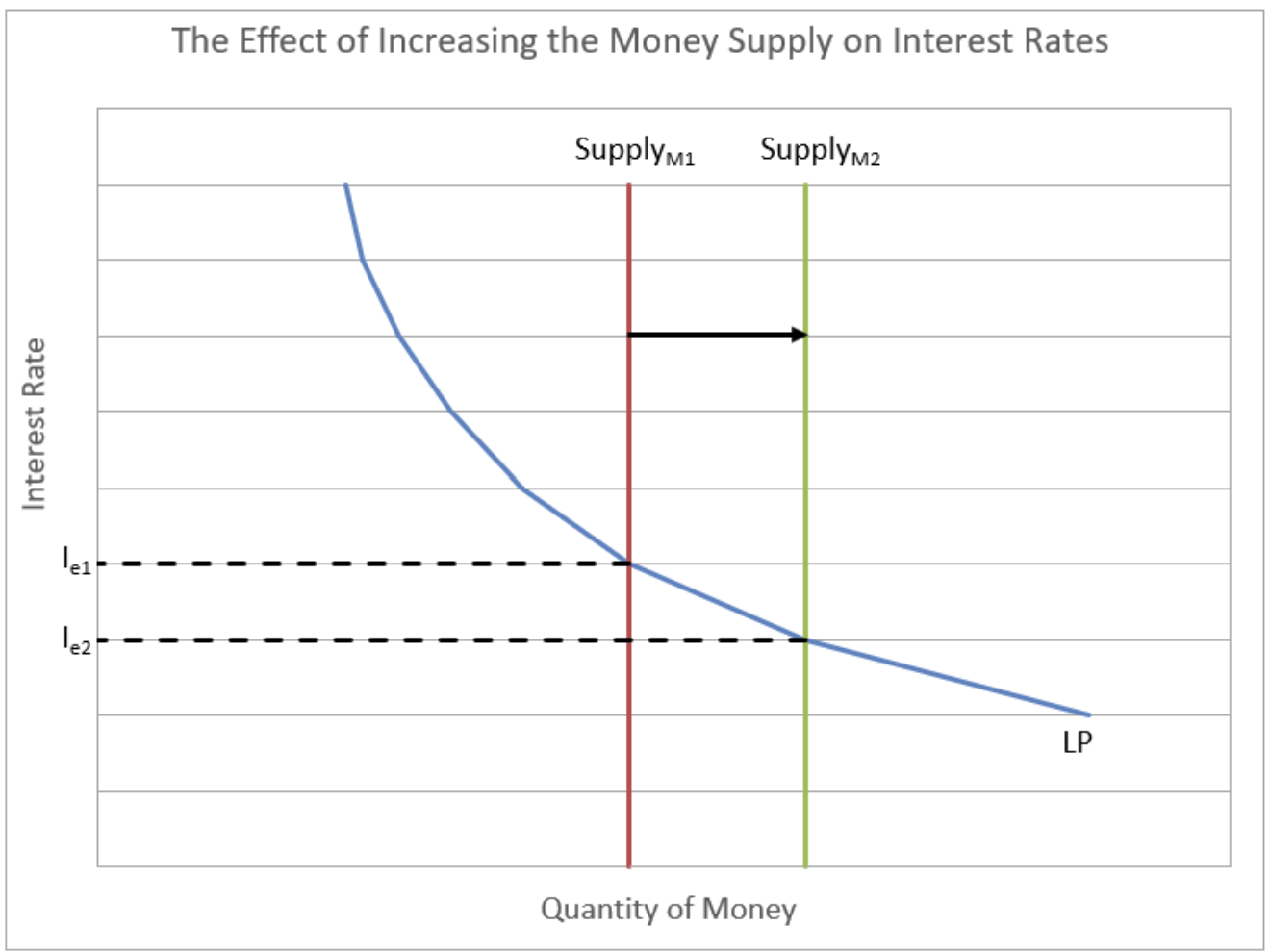

Understanding marketplace liquidity models is crucial for anyone involved in trading or investing within financial markets. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant impact on its price. This guide will explore the different types of liquidity models that define how assets operate within a marketplace. Key models include the order book model, where buy and sell orders are matched based on price and time, and the liquidation model, which focuses on how quickly assets can be sold under duress.

Furthermore, it's important to recognize the impact of liquidity on market efficiency and participant behavior. A market that exhibits high liquidity usually has lower spreads between bid and ask prices, enhancing the trading experience for users. Conversely, low liquidity can lead to heightened volatility and price slippage. In this guide, we’ll also cover various factors that affect liquidity, such as trading volume, the number of market participants, and external economic conditions. By understanding these components, traders can make more informed decisions in their respective markets.

Counter-Strike is a highly popular first-person shooter game that combines strategy, teamwork, and quick reflexes. Players can enhance their gaming experience through various means, including the use of a daddyskins promo code to acquire in-game skins and items. The game has evolved over the years, and the competitive scene continues to thrive with numerous tournaments worldwide.

How Liquidity Affects Your Marketplace Success

Liquidity is a crucial factor that can significantly impact the success of your marketplace. It refers to the ease with which assets can be bought or sold in the market without affecting their price. In a high liquidity environment, buyers and sellers can execute trades swiftly, leading to a more dynamic marketplace. This not only attracts more participants but also helps in stabilizing prices, allowing sellers to find buyers quickly and efficiently. Thus, understanding and enhancing liquidity can be the difference between a thriving marketplace and one that stagnates.

One way to boost liquidity is by fostering a diverse range of products and services, ensuring that there is something for everyone. Additionally, implementing user-friendly features such as streamlined payment processes and effective communication channels can further enhance liquidity. In the end, a marketplace that prioritizes liquidity not only provides a better experience for users but also enhances profitability. By focusing on these elements, you can position your marketplace for long-term success and growth.

What Are the Best Strategies for Enhancing Marketplace Liquidity?

Enhancing marketplace liquidity is crucial for ensuring efficient trading and investment. One of the most effective strategies to improve liquidity is by increasing participation from various market players, such as institutional investors and retail traders. This can be achieved through targeted marketing campaigns and education initiatives that inform potential participants about the benefits of engaging with the marketplace. Additionally, offering incentives like reduced transaction fees or rewards for early adopters can further encourage participation, leading to a more vibrant trading environment.

Another key strategy revolves around the implementation of advanced technology solutions that facilitate better trade execution and pricing. Utilizing algorithms for price discovery and real-time analytics can help in identifying liquidity opportunities quickly. Furthermore, integrating features like automated market making and order book depth can enhance the user experience and encourage higher volumes of transactions. By focusing on these technological advancements, marketplace operators can significantly enhance liquidity, ultimately benefiting all users involved.