Caribbean Business Insights

Exploring the vibrant business landscape of the Caribbean.

Marketplace Liquidity Models: Where Buyers and Sellers Dance

Discover the secrets behind marketplace liquidity models and learn how buyers and sellers create the perfect dance of opportunity!

Understanding Marketplace Liquidity Models: Key Factors and Dynamics

Understanding marketplace liquidity models is crucial for participants looking to navigate the complexities of various trading environments. Liquidity refers to how easily assets can be bought or sold without causing significant price fluctuations. There are several key factors that influence liquidity models, including the number of active participants, the volume of trades, and the frequency of transactions. In a highly liquid marketplace, assets can be quickly converted to cash, making it a desirable trait for traders and investors alike.

Additionally, the dynamics of marketplace liquidity are affected by external elements such as regulatory changes, market sentiment, and technological advancements. For instance, increased access to trading platforms can enhance liquidity by attracting more participants, while sudden market events can lead to rapid changes in liquidity conditions. Understanding these dynamics allows traders to make informed decisions, optimizing their strategies based on the current liquidity landscape and helping them to mitigate risks associated with less liquid markets.

Counter-Strike is a highly popular first-person shooter game that puts players in the midst of team-based tactical combat. With its origins dating back to a mod for Half-Life, it has evolved into several versions, including Counter-Strike: Global Offensive. Players can enhance their gaming experience by utilizing exclusive offers, such as the daddyskins promo code, to obtain skins and in-game items.

How do Liquidity Models Impact Buyer and Seller Interactions?

The interaction between buyers and sellers is significantly influenced by liquidity models. In financial markets, liquidity refers to the ease with which assets can be bought or sold without affecting their price. When liquidity is high, buyers can quickly purchase assets without facing large price changes, while sellers can dispose of their assets rapidly. This dynamic encourages more transactions, fostering a healthy market environment where both parties feel confident in their interactions. Conversely, low liquidity levels can lead to wider bid-ask spreads, creating a barrier for buyers and sellers that can stifle engagement and drive market inefficiencies.

Moreover, liquidity models also dictate the strategies employed by buyers and sellers. For instance, a buyer aware of low liquidity may exercise caution, opting to place limit orders to avoid unfavorable pricing. On the other hand, sellers might be forced to lower their asking prices to attract buyers in a less liquid market. This interplay not only shapes individual trading experiences but also influences overall market stability and price discovery. Understanding these liquidity dynamics is crucial for investors seeking to optimize their buying and selling strategies.

The Dance of Buyers and Sellers: Exploring the Mechanics of Marketplace Liquidity

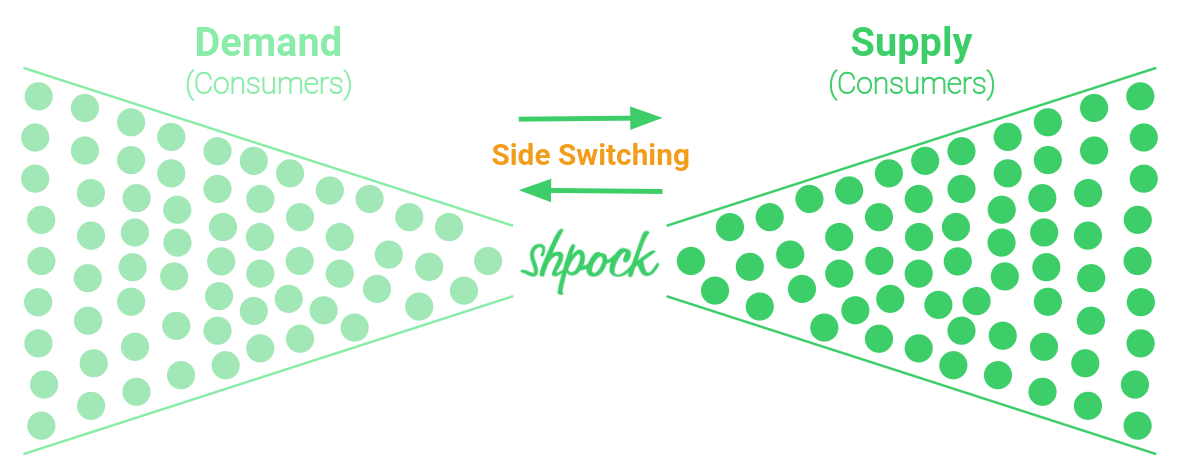

The dance of buyers and sellers is a fundamental aspect of any marketplace, heavily influencing its liquidity and overall efficiency. When we talk about marketplace liquidity, we refer to the ease with which assets can be bought and sold without causing significant price fluctuations. A liquid market is characterized by a high volume of transactions, where buyers and sellers can swiftly find each other. This dynamic creates a healthy ecosystem where market participants can trust that their assets can be converted to cash quickly, which in turn fosters greater participation and investment.

Several factors contribute to the mechanics of marketplace liquidity. Firstly, the number and activity levels of participants play a crucial role. As more buyers engage in the market, the demand increases, prompting sellers to respond with competitive pricing. Additionally, the presence of market makers can enhance liquidity by providing stability and facilitating trades at any time. The interplay between buyers and sellers is thus akin to a dance, where each party adapts to the movements of the other, ultimately creating a more balanced and liquid market.